Our new report considers how shifting US regulation offers both headwinds and tailwinds for healthcare investors.

The research explores the regulatory landscape and its influence on the competitive positioning of healthcare companies, discussing how:

1) Regulatory forces can act as strong headwinds, particularly for businesses involved in the provision of medical care services or insurance. In our view these sub-sectors are less attractive than other areas of healthcare

2) Some of these same regulatory forces can act as tailwinds for healthcare companies, especially for growth focused technology businesses where long-term success is more dependent on widespread adoption than on payer rates.

3) In these select cases long-term regulatory shifts can create asymmetry to the upside for companies’ return profile.

‘Examining Healthcare’ argues for a nuanced approach to effective capital allocation in the healthcare sector, including a dual focus on limiting disruption from risks that are difficult to quantify and finding opportunities where regulatory shifts can accelerate the adoption of proprietary science or technology.

Hayfin is pleased to announce that, through its Direct Lending strategy, it has provided fully underwritten debt financing to support the acquisition of V.Group by a consortium led by STAR Capital. Hayfin’s support for the acquisition extends its long-standing relationship with V.Group and its management team, having been a lender to the business since 2020.

V.Group is a global provider of mission-critical services to the maritime industry, such as technical ship and crew management, crew welfare services (e.g. catering, travel, and digital wallets & payment cards), leveraged procurement, technical services, specialist insurance broking, and modern shipping-specific digital solutions.

Headquartered in London, it has a global presence with 50 offices across 30 countries and employs c. 2,900 employees worldwide. In addition, the group has access to the world’s largest international network of over 44,000 seafarers to provide its clients with professional crews. It currently services approximately 3,500 vessels from pedigree shipowners and managers alike, with safety and compliance at the heart of V.Group’s operating model.

Andreas Povlsen, Head of Maritime at Hayfin, comments: “This latest investment builds on Hayfin’s track record in the shipping sector and is the direct result of strong collaboration between our specialist maritime team and the broader Private Credit platform focused on originating corporate lending opportunities. We are delighted to continue our journey with V.Group alongside its impressive management team and its new partners in the consortium led by STAR Capital.”

Disclosure

Past performance is not a guarantee of future performance. No investment, strategy or tested process can guarantee results. Please note, fees reduce returns to investors.

That it has been a comparatively tough few years for private equity is news to nobody. The rate-hiking cycle of 2022-23 has dampened M&A activity, impacted PE managers’ return expectations and prompted LPs to review their allocations to the asset class.

These developments have raised interesting questions for private credit. On the one hand, the same higher-interest-rate environment had prompted talk of a ‘golden age’ of private credit. On the other, the alternative lending market is widely perceived to be dependent, in large part, on strong PE-led M&A activity for its own deployment, as well as the return, of capital.

Last week, Hayfin attended IPEM, one of the leading European conferences on private markets, in Paris. The official theme of ‘Forging Confidence’ reflected the sense of cautious optimism towards tentative signs of an early-stage recovery in deal volumes. The event provided us and our peers with a chance to reflect on the unusual environment of the past few years and what this means for private credit going forward.

Newcomers find European private credit a tough nut to crack

There has been a notable change in the mood music between last summer’s flagship private market conferences and the conversations taking place last week with regard to competitive dynamics in private credit.

Last year, many investors and managers were suggesting that the market was about to be shaken up by a flurry of new managers. Both alternative investment firms and traditional asset managers were expected to pile into the asset class.

That sentiment has now been turned on its head. A number of the newer entrants to the asset class are reportedly either reevaluating their private credit strategies or scaling back their operations entirely. Subdued M&A activity and, by extension, direct lending volumes have been felt more sensitively by alternative credit providers who do not have an established presence and are looking to break into the market.

The concentration of activity among a relatively small number of participants has been a longstanding feature of the European private credit market. The top 25 private credit funds in Europe have accounted for up to three-quarters of the total capital raised since 2007. By contrast, in the US, the top 25 funds account for approximately half of total fundraising, there is a long tail of smaller funds that hold a large pool of capital and can better compete with their larger peers on deal sourcing.

In the European market, in other words, capital and investment opportunities accrue to the top 25 largest private credit funds, with the Direct Lending market in which we operate having 10 or fewer direct competitors.

Advantages of incumbency laid bare

The lingering uncertainty about the global macroeconomic environment, as well as the mismatch in valuation expectations between the buy-side and sell-side, all of which served to suppress transaction activity over the last couple of years, has begun to abate. We are seeing greater convergence on valuations and growing confidence that, if sponsors bring the right assets to the market, they are less likely to falter during the sale process.

However, it remains difficult to assess when M&A activity will reach the top of its cycle again. It’s quite likely that a higher-interest-rate environment will remain a drag on a fully fledged rebound.

Private credit firms that are less heavily reliant on an opportunity set defined by the cyclical nature of M&A will therefore continue to enjoy an advantage in deploying capital over the years ahead.

In truth, large parts of the market do depend on this cycle. Once again, the established players with incumbency advantage are best placed to access narrower PE-led processes when M&A activity is subdued, and sponsors revert their focus on bolt-ons for existing portfolio companies. For example, in recent years, our existing exposure to more than 80 borrowers across our Direct Lending portfolios has allowed us to continue sourcing significant volumes of deal flow in high-quality companies we know well.

The ability to originate these preferred deals is particularly advantageous in an investment environment characterised by a growing bifurcation in credit quality. Lenders without a large and sophisticated deal origination network will risk being adversely selected and ending up with concentrated exposure to second-tier credits, such as businesses that are more exposed to cyclicality, with tighter margins or more likely to struggle in a recessionary environment due to being smaller. Those who have that capability and the incumbency advantage can access deals with lower leverage and better documentation protections than has been the norm in recent years, at pricing levels that make for highly attractive risk-adjusted returns.

Return of the broadly syndicated loan market?

Finally, the post-summer gathering at IPEM provided an opportunity to reflect on another widely predicted trend that has not materialised to the extent that many expected.

The first half of 2024 witnessed the widely heralded return of the broadly syndicated loan market (BSL), offering many upper-mid-market borrowers another avenue for financing, often at tighter spreads and more flexible documentation. This drove speculation that private credit managers would need to cut margins to compete.

Our view had always been that a portion of deals which were financed by private credit in 2022 and early 2023, when leveraged finance markets were effectively closed, would be refinanced back into the syndicated markets. However, we predicted that there would remain a still-large opportunity set of sponsors and businesses for whom the tightest possible pricing isn’t their sole concern. That could be mid-market businesses less likely to find a solution on syndicated markets, or large-cap sponsors investing in a challenging sector or pursuing a buy-and-build strategy which requires incremental capital.

It has certainly become more important for private credit managers to demonstrate their ability to access attractive deal flow involving companies in sectors, size brackets or situations where the certainty, efficiency, flexibility and resilience offered by a direct lender outweigh the purely economic or documentary incentives to tap the BSL market. But we believe that the comparative deal volumes in the BSL and private credit markets are bearing out our assessment that there is a large and fast-growing white space not covered by syndicated markets, available at a risk-adjusted-return profile that meets LPs’ expectations.

Hayfin is pleased to announce that it has provided the debt financing to support TowerBrook Capital Partners’ (“TowerBrook”) acquisition of a majority stake in IDAK Food Group (“IDAK”) from Invision and Nord Holding.

IDAK is a strongly networked group of specialised companies and manufacturers operating across the premium frozen food sector. In recent years, IDAK has delivered strong growth, both organically and inorganically through strategic acquisitions in Switzerland and further abroad.

The change of ownership will aim to grow IDAK’s capital base and provide the company with a platform to pursue further M&A opportunities across Europe. The well-established IDAK management team, led by CEO Christof Lehmann, will remain in place.

Robert da Costa, Director, Private Credit, commented: “Hayfin has a longstanding relationship with TowerBrook and we are pleased to provide the financing for this transaction. We have been impressed by IDAK’s management team who have delivered exceptional historical performance. We look forward to working with the IDAK team and supporting their continued growth trajectory alongside TowerBrook.”

Olaf Hartmann, Head of DACH and Portfolio Manager for Private Credit, added: “IDAK has become one of the most exciting European food businesses in recent years, and we are delighted to be partnering with them to support their next stage of growth. The transaction also demonstrates the benefits of our local footprint and the strength of our DACH franchise, an area where we see significant opportunities going forward.”

Disclosure

Past performance is not a guarantee of future performance. No investment, strategy or tested process can guarantee results. Please note, fees reduce returns to investors.

- Transaction follows successful long-term partnership with BCI and delivers on Hayfin’s

objectives for greater team ownership, alignment, and incentivization - No changes expected to Hayfin’s strategy, investment process, leadership, or day-to-day operations

- BCI will remain a strategic limited partner in certain Hayfin funds post-closing

Hayfin today announced it has entered into an agreement with Arctos Partners (“Arctos”), a private investment firm, to support a management buyout of the business, acquiring British Columbia Investment Management Corporation’s (“BCI”) majority stake. Financial terms were not disclosed.

This new partnership delivers Hayfin’s long-term objectives of greater team ownership, alignment, and incentivization, as well as generating superior and consistent risk-adjusted returns for clients. Arctos, via its Keystone strategy, which provides strategic partnership to leading financial sponsors, through bespoke growth capital and liquidity solutions, has underwritten 100 percent of the funding and will facilitate the Hayfin team becoming the majority owners of the common equity. BCI will remain a strategic limited partner in certain Hayfin funds.

Founded in 2009, Hayfin specializes in providing European and North American credit and private equity investment solutions to a global investor base. BCI acquired a majority stake in the firm in January 2017, and since that time Hayfin has experienced strong sustained growth and momentum, quadrupling its AUM, adding senior talent, and diversifying and expanding its strategies. Hayfin’s product offering now spans direct lending, special opportunities, tactical solutions, high-yield/syndicated loans, healthcare opportunities, maritime yield and private equity solutions.

Tim Flynn, Co-Founder and Chief Executive Officer at Hayfin, said: “This is an exciting new chapter that will support Hayfin’s ongoing growth while preserving our core identity and operational autonomy. Arctos has a best-in-class, like-minded team that recognizes the enormous opportunity available to investors in the credit markets today, and their experience only enhances our ability to serve our investors, borrowers and sponsors. Our long-standing team is grateful to BCI for the last seven years of successful collaboration, and we look forward to a continued relationship with them as an investor in our products.”

Ian Charles, Co-Founder and Managing Partner at Arctos, said: “Hayfin has an excellent leadership team supported by a robust bench of talent, proven track record and disciplined investment style. Their strategic growth ambitions make them an ideal partner for Arctos Keystone and provides our investors access to Europe’s leading private credit platform as that market continues to see rapid growth. We look forward to supporting Hayfin’s long-tenured investment team in delivering our shared objective of generating attractive risk-adjusted returns for our respective investors.”

Jim Pittman, Executive Vice President & Global Head of Private Equity at BCI, said: “We are delighted to have reached this agreement with Hayfin and Arctos, delivering an excellent outcome for BCI’s pension plan and insurance clients. We’re extremely proud of the partnership we forged with the Hayfin team over the past seven years, which has delivered significant growth in a critical period for the private credit market. We remain confident in Hayfin’s investment strategies and are pleased to remain as a limited partner in certain funds.”

Hayfin is pleased to announce that it is the lead lender providing the debt financing to support the acquisition of international events company, Easyfairs, by Cobepa, Inflexion and the existing management team.

Easyfairs is one of the world’s top ten events companies, welcoming more than one million visitors annually and 23,000 exhibitors to its events. Easyfairs organises 110 event titles in 12 countries across 12 industry verticals. It also manages eight event venues in Belgium, the Netherlands and Sweden.

The transaction will enable Easyfairs to drive faster organic growth through new event launches and geo-cloning of existing events, extend its geographic and sector footprint, enhance its position as a sector frontrunner in big data and artificial intelligence technologies, and unlock further strategic M&A opportunities.

Sebastiaan Tito, Principal, Direct Lending at Hayfin, commented: “Our investment into the acquisition of Easyfairs demonstrates Hayfin’s extensive experience in the events sector as well as our ability to successfully position ourselves in attractive market segments and execute financing agreements of significant scale to provide speed and certainty to our partners. We are excited to partner with the shareholders in supporting Easyfairs, a business with great potential, supported by a strong pipeline of organic and inorganic growth opportunities.”

Disclosure

Past performance is not a guarantee of future performance. No investment, strategy or tested process can guarantee results. Please note, fees reduce returns to investors.

A major theme within global finance over the past 15 years has been the migration of leveraged lending away from banks and towards private debt funds.

This theme was initially most relevant for mid-market companies but has grown increasingly important for upper-mid market and large-cap borrowers as well.

Hayfin co-founder and CEO Tim Flynn was featured on Private Market Talks providing insight into the Hayfin team’s dynamic, innovative approach to direct lending and leveraged finance. Tim reflected on learnings from his career journey, from starting out as a beekeeper to founding a leading European alternative asset management firm, and how he applies the learnings from each experience to continue to enhance the Hayfin business. He also provides a view on the opportunities and challenges he sees within the private markets, and how these are informing Hayfin’s strategy.

Hayfin today announces that it has participated in the financing to support Bridgepoint’s acquisition of French residential property management services company Nexity ADB from its parent company Nexity Group.

Nexity Group is France’s largest publicly listed real estate developer. The carve-out of the residential property management services division will provide Nexity ADB with a stronger platform to grow the business as a standalone company.

Alban Senlis, Head of Hayfin Private Credit in France, commented: “We are pleased to be partnered with Bridgepoint, who have deep expertise and an outstanding track record in the sector. This is a highly attractive investment to Hayfin given the company’s solid and resilient trading performance, as well as its potential for further growth as an independent business with the right level of funding behind it. We look forward to working with our new partners as Nexity ABD embarks on its next phase of growth.”

Disclaimer: Past performance is not a guarantee of future performance. No investment, strategy or tested process can guarantee results. Please note, fees reduce returns to investors.

Summary

- CCC bonds are at the bottom of the high yield ratings spectrum. Comprising only 5-6% of the relevant European indices, in widening markets, CCCs tend to absorb much of the price dispersion.

- Over the last decade, credit markets have been largely undifferentiated, and European high yield CCCs have not offered good risk reward. However, at current market pricing CCCs offer a yield-to-maturity of 19% and trade at an historically wide premium of more than 1,000 basis points over the single-B credit index.

- Credit ratings are driven by two factors – probability of default and expected recoveries. Within the European CCC universe, Hayfin focuses on the roughly two-thirds of CCC instruments that it believes carry a lower default probability and may offer meaningful positive price convexity.

- Portfolio construction at Hayfin is driven by high conviction and not by benchmark composition. We select securities idiosyncratically, based on sector, credit quality, and price and apply a detailed investment process – combining bottom credit analysis and an active and flexible portfolio framework; thus allowing us to extract interesting risk-adjusted returns within speculatively-rated credit categories.

Corporate bonds and loans rated CCC by S&P or Caa by Moody’s (together “CCCs”) are the lowest rung on the credit quality scale — just above default — and represent high non-payment risk. The rating factors “both the likelihood of default and any financial loss suffered” and is indicative of vulnerability to any adverse conditions1. CCCs today only represent around 5-6% of the European Leveraged Loan and European High Yield Bond indices and are therefore not a core part of the investment universe — furthermore, credit managers may actively aim to minimise exposure to CCCs as part of downside avoidance.

CCCs – a history

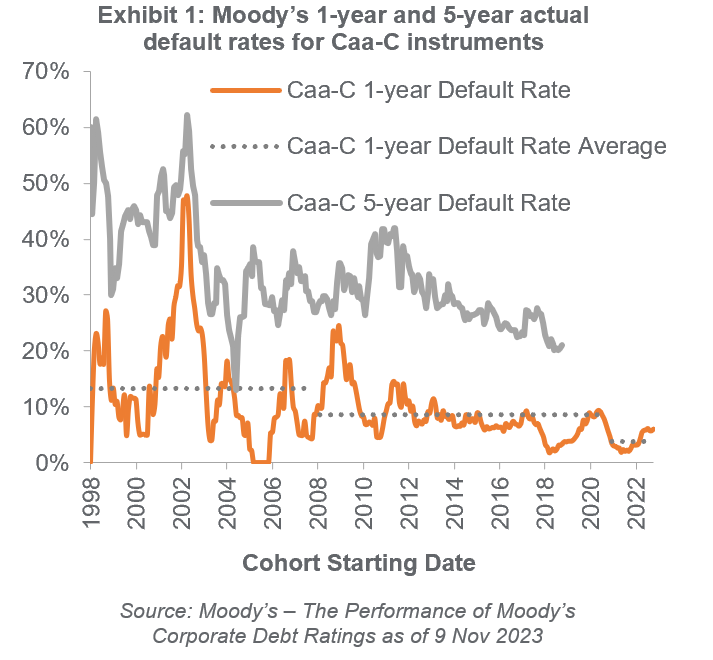

Historically, a large proportion of CCC rated issuers had poor financial or operational momentum which resulted in downgrades from single B to CCC and then default relatively soon after. The complexion of the CCC universe is now markedly different — many CCC instruments have been assigned that rating at issuance rather than being downgraded due to underperformance. This has resulted in a lower default rate for CCCs in the post-Global Financial Crisis era. From 1998-2007, 37% of CCC rated instruments would default within any 5-year period, with peaks of 60% during the Asian financial crisis and the dotcom bubble, and 40% during the Global Financial Crisis and the European Sovereign Crisis. Over the last 5 years that default rate is meaningfully lower at 21%. Similarly, between 1998 and 2007, 13% of CCCs would default in any given 1-year period compared to an average of just 3.7% over the last 24 months.

What is the CCC value proposition today?

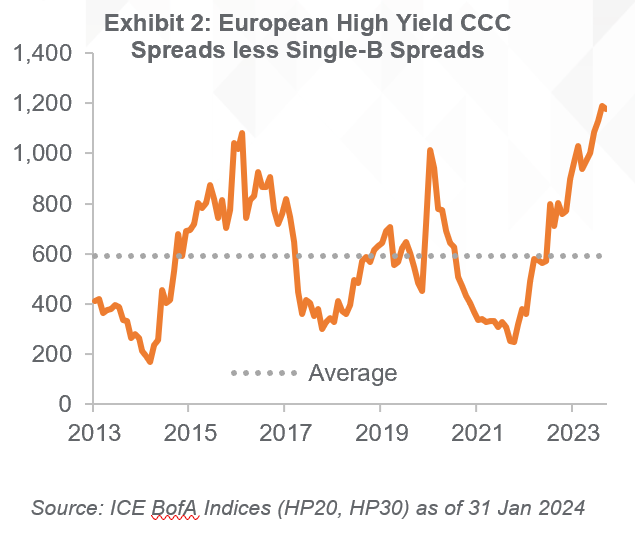

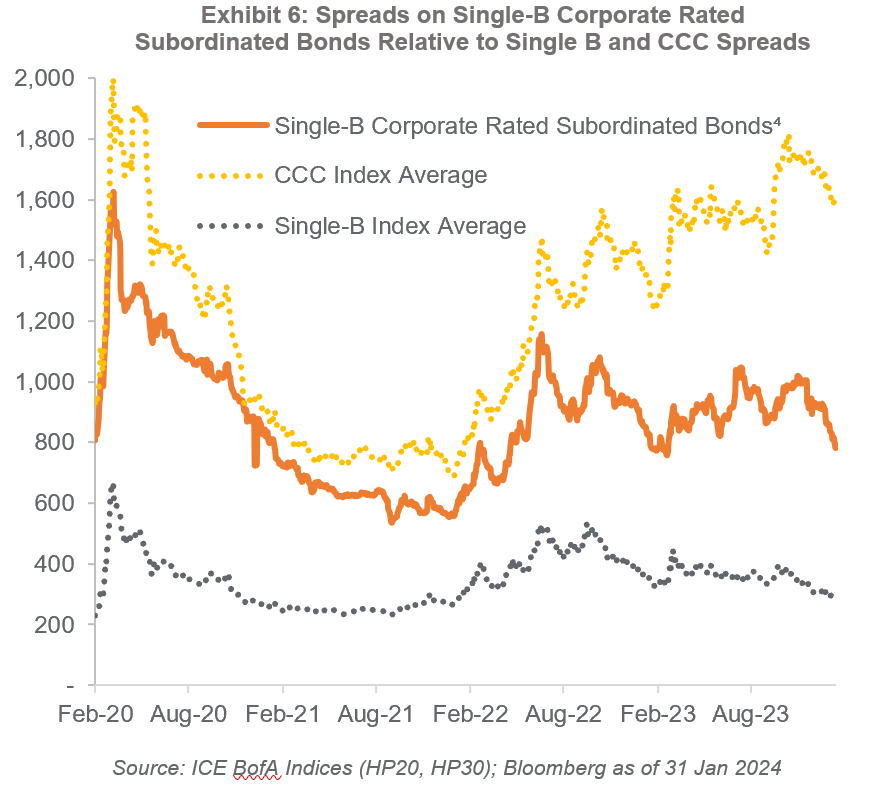

Over the past 10-years2, European CCC high yield as a cohort has delivered an annualised return of 3.0% — below the broader high yield index of 3.5% and the BB-B ratings categories, which have returned 3.6%. Adjusted for volatility, CCCs look even less compelling from an asset allocation point of view. However, the CCC performance differential widened through 2023 and today CCCs are priced at an historically large premium to the rest of the asset class. CCC high yield trades at a spread of 1,600 basis points (bps), which is an unprecedented 1,000 bps premium over Single-B rated high yield — well above the 10-year average spread differential of 592 bps. CCC yield-to-maturity of 19% compares to the broader market at 7%.

The outsized premium for CCCs today warrants the question: is this a compelling time to invest in CCCs, or are we simply being compensated for elevated default losses ahead?

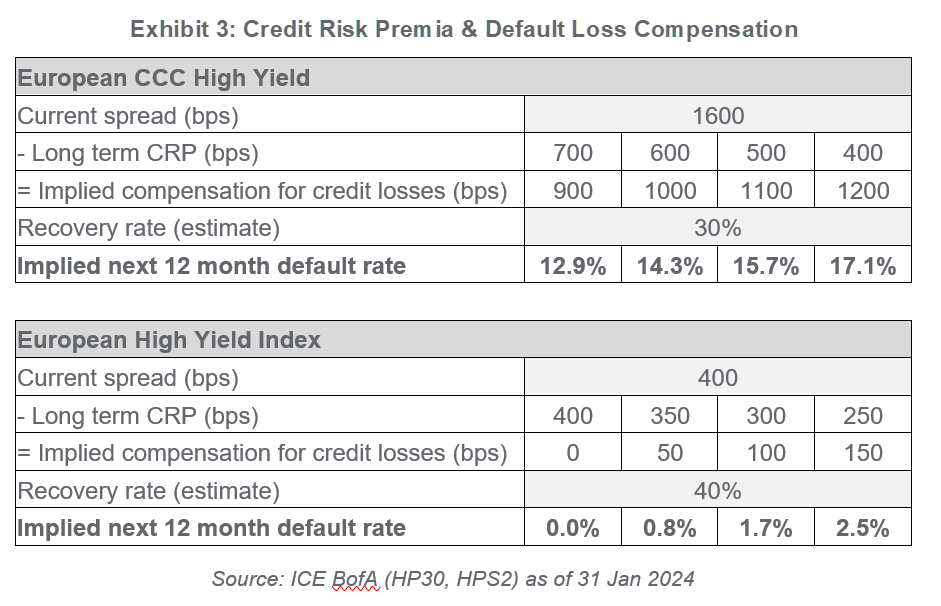

Taking a range of estimates for the long-term credit risk premium (CRP)3 and an assumption on recovery rates, we can impute the compensation for default losses and solve for the default rate priced by the market. Current pricing for CCCs implies a 1-year default rate percentage in the mid-teens, which is much more in line with pre-GFC levels. In contrast, broader high yield index pricing currently implies a low single digit default rate. Current pricing therefore anticipates a meaningful disconnect between the prospects for the CCC cohort as compared to the broader high yield market.

Differentiating within CCCs

Exhibit 4

| Corporate Rating | Security Rating | |

| Single-B | Higher Ranking Debt | Single-B or better (i.e. unchanged or notched up) |

| Lower Ranking Debt | CCC (notched down) | |

We would argue against a broad-brush ‘cohort’ approach to CCCs. Within the CCC universe there is a broad spectrum of credit quality. While some CCCs are the result of credit downgrades of underperforming businesses with unsustainable capital structures, others are of distinctly better credit quality, issued out of companies that have multiple tiers of debt in their capital structure.

Typically rating agencies ‘notch down’ lower ranking debt. Often single-B credit quality corporate issuers will have any lower ranking debt notched down to CCC – reflective of recovery rate rather than prospects of default.

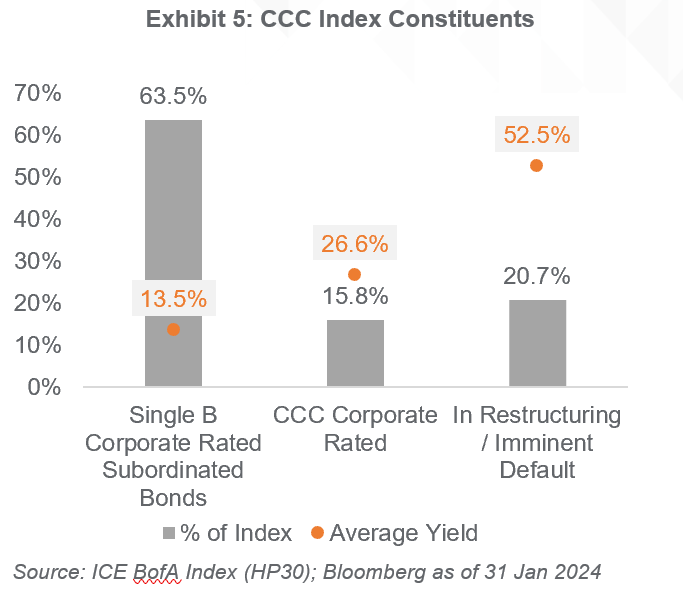

Broadly we can segment CCCs in the European High Yield Index into the following categories, as shown graphically in Exhibit 5, in order of decreasing credit quality:

- Notched down securities with a better corporate credit profile (Single-B or better);

- Securities where both the corporate credit profile and the security profile are CCC-rated; and

- Securities that have defaulted or are imminently expected to default – these securities are much more likely to trade on recovery value (cents on the dollar) where spreads become somewhat meaningless.

Which CCCs can be an attractive risk?

Applying the framework above and reviewing each security in the European high yield CCC universe, we can identify roughly two-thirds of the index as ‘higher credit quality’ (Single-B corporate rating) with lower risk of default. The remaining one-third of the index is made up of lower quality credits with higher risk of default.

The higher-quality issuers still offer a high return without undue risk – these instruments offer an average yield of 13%, which is significantly higher than Single-Bs. Simply buying the whole CCC universe would result in a yield uplift to 19%, however this would mean significantly increasing the risk of defaults within a portfolio.

Credit Case Study

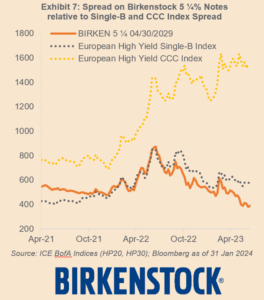

In February 2021, L Catterton acquired a majority stake in Birkenstock at a 17x Enterprise Value to EBITDA multiple. Birkenstock manufactures their iconic sandals from a manufacturing base in Germany. To support the acquisition, Birkenstock issued a senior secured EUR term loan (rated B by S&P) through 4.9x net leverage, and a EUR unsecured senior note (rated CCC by S&P) through 6.9x. Despite significant financial flexibility and valuation coverage, the rating agencies notched down the senior notes because of their relative size and low projected recovery in a default scenario.

Ultimately, Birkenstock de-levered rapidly from strong operating performance and cashflow generation and the market overlooked the CCC rating. In fact, the Birkenstock senior notes traded consistently tighter than most single-B rated securities. In July 2023 the notes were upgraded to B- and in November 2023, post-IPO, the issuer rating of Birkenstock was upgraded to BB-, with the notes remaining two notches lower at B.

The job of an investment manager is to identify the best relative value, adjusted for risk — where we are comfortable with the issuer’s competitive positioning, its exposure to the economic cycle, ability to generative positive free cashflow and the sustainability of its capital structure. Ultimately, we must be comfortable that the debt is serviceable and adequately covered from a valuation perspective. Once invested, it is critical to monitor the development of key risks and take appropriate and timely action if the trajectory on these key risks shifts negatively.

In summary, CCCs offer an outsized premium today relative to the history of the asset class. Whilst some of that premium may be required compensation for default losses, there is a significant degree of credit quality differentiation within the CCC cohort. Active and disciplined credit selection is key to delivering attractive risk adjusted returns, isolating the undesirable elements of the benchmark exposure. Hayfin’s current framework emphasises potential for CCCs to add value at market weight where the downside risks can be adequately quantified and managed.

For further information, please reach out to your primary relationship manager or to Investor Relations at IR@hayfin.com.

Sources:

1By the rating agencies, S&P and Moody’s.

2Data to 31 December 2023.

3CRP ranges based on Goldman Sachs estimates, see Goldman Sachs –Global Credit Trader – 8 Jun 23.

4Selected bonds include: Altice International, Banijay, Biogroup, Birkenstock (until upgrade 19/7/2023), Cerba, Foncia, Masmovil, Modulaire, Picard, SFR, TKE, Eviosys, T-Mobile NL, Verisure (until upgrade 15/5/2023), BMC, Ceramtec, Kantar, Kloeckner Pentaplast, Arxada, Merlin, Upfield, Solenis and Tui Cruises. Source: Bloomberg; ICE BAML Indices (HP30, HPS2).