-

About Hayfin

About Hayfin

Since our formation in 2009, Hayfin has grown to become Europe’s leading alternative asset management platform. We have developed in a measured way to build transatlantic capabilities and establish a growing local presence in Asia.

-

Strategies

Strategies

We provide critical debt, equity and hybrid capital solutions tailored to the European market. Our product suite is designed to address every financing need of non-investment grade borrowers, providing broad and flexible mandates. Covering both primary and secondary markets and providing financing across the spectrum from growth to stress or distress.

-

People

People

Led by Hayfin’s Executive Committee, our international team of industry professionals represent the best experience and expertise in the market. Our people embrace our values and culture contributing to our collective success.

-

Responsibility

- News & Views

- Contact

- Home

- News & Views

- Not all CCCs are Created Equal

Views 19th February 2024

Not all CCCs are Created Equal

Summary

- CCC bonds are at the bottom of the high yield ratings spectrum. Comprising only 5-6% of the relevant European indices, in widening markets, CCCs tend to absorb much of the price dispersion.

- Over the last decade, credit markets have been largely undifferentiated, and European high yield CCCs have not offered good risk reward. However, at current market pricing CCCs offer a yield-to-maturity of 19% and trade at an historically wide premium of more than 1,000 basis points over the single-B credit index.

- Credit ratings are driven by two factors – probability of default and expected recoveries. Within the European CCC universe, Hayfin focuses on the roughly two-thirds of CCC instruments that it believes carry a lower default probability and may offer meaningful positive price convexity.

- Portfolio construction at Hayfin is driven by high conviction and not by benchmark composition. We select securities idiosyncratically, based on sector, credit quality, and price and apply a detailed investment process – combining bottom credit analysis and an active and flexible portfolio framework; thus allowing us to extract interesting risk-adjusted returns within speculatively-rated credit categories.

Corporate bonds and loans rated CCC by S&P or Caa by Moody’s (together “CCCs”) are the lowest rung on the credit quality scale — just above default — and represent high non-payment risk. The rating factors “both the likelihood of default and any financial loss suffered” and is indicative of vulnerability to any adverse conditions1. CCCs today only represent around 5-6% of the European Leveraged Loan and European High Yield Bond indices and are therefore not a core part of the investment universe — furthermore, credit managers may actively aim to minimise exposure to CCCs as part of downside avoidance.

CCCs – a history

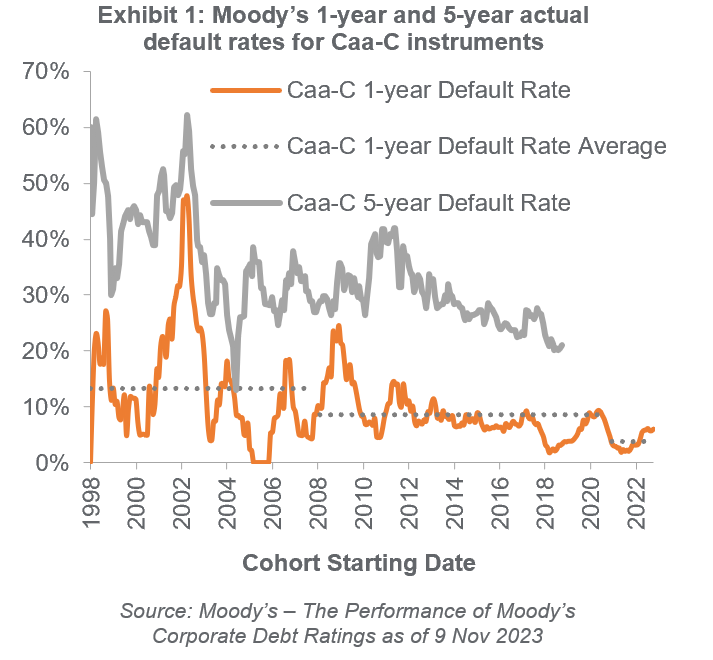

Historically, a large proportion of CCC rated issuers had poor financial or operational momentum which resulted in downgrades from single B to CCC and then default relatively soon after. The complexion of the CCC universe is now markedly different — many CCC instruments have been assigned that rating at issuance rather than being downgraded due to underperformance. This has resulted in a lower default rate for CCCs in the post-Global Financial Crisis era. From 1998-2007, 37% of CCC rated instruments would default within any 5-year period, with peaks of 60% during the Asian financial crisis and the dotcom bubble, and 40% during the Global Financial Crisis and the European Sovereign Crisis. Over the last 5 years that default rate is meaningfully lower at 21%. Similarly, between 1998 and 2007, 13% of CCCs would default in any given 1-year period compared to an average of just 3.7% over the last 24 months.

What is the CCC value proposition today?

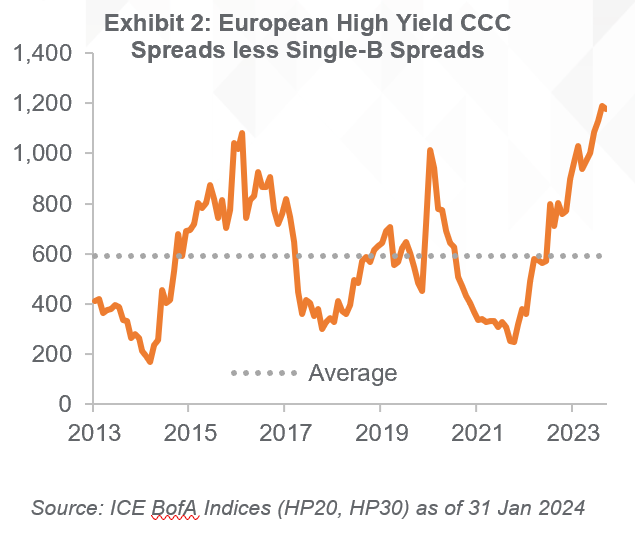

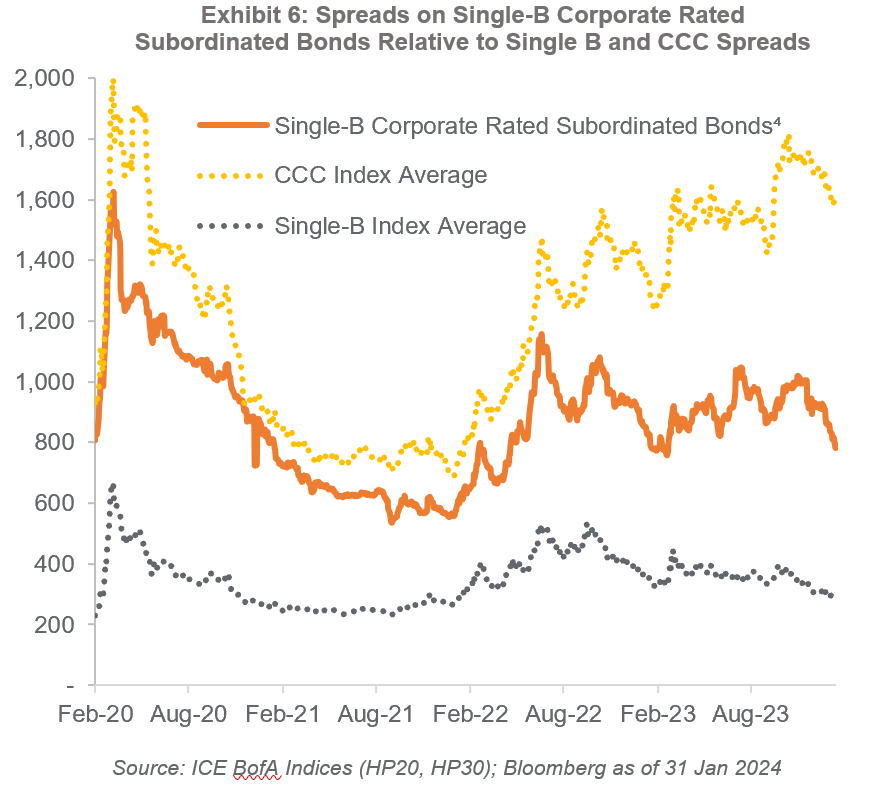

Over the past 10-years2, European CCC high yield as a cohort has delivered an annualised return of 3.0% — below the broader high yield index of 3.5% and the BB-B ratings categories, which have returned 3.6%. Adjusted for volatility, CCCs look even less compelling from an asset allocation point of view. However, the CCC performance differential widened through 2023 and today CCCs are priced at an historically large premium to the rest of the asset class. CCC high yield trades at a spread of 1,600 basis points (bps), which is an unprecedented 1,000 bps premium over Single-B rated high yield — well above the 10-year average spread differential of 592 bps. CCC yield-to-maturity of 19% compares to the broader market at 7%.

The outsized premium for CCCs today warrants the question: is this a compelling time to invest in CCCs, or are we simply being compensated for elevated default losses ahead?

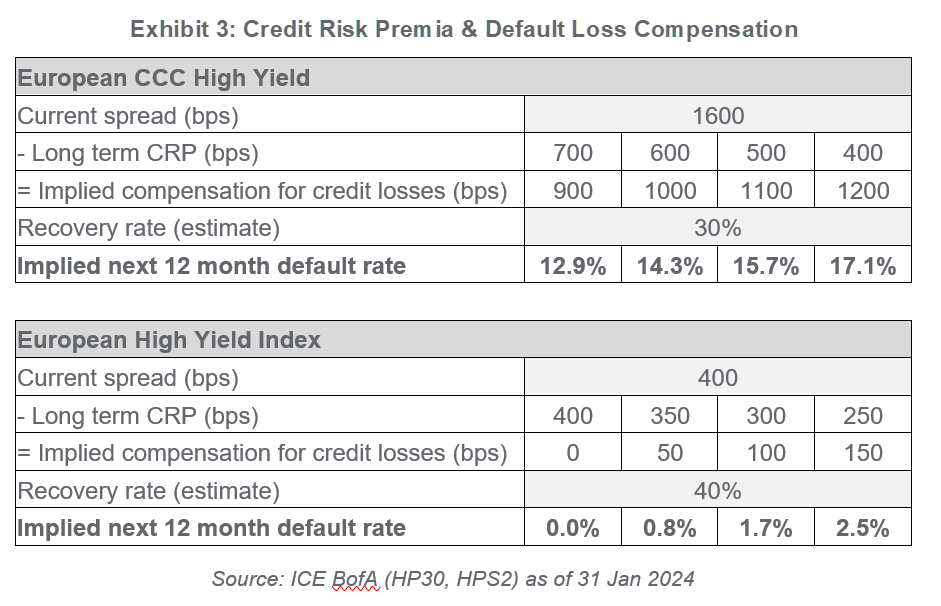

Taking a range of estimates for the long-term credit risk premium (CRP)3 and an assumption on recovery rates, we can impute the compensation for default losses and solve for the default rate priced by the market. Current pricing for CCCs implies a 1-year default rate percentage in the mid-teens, which is much more in line with pre-GFC levels. In contrast, broader high yield index pricing currently implies a low single digit default rate. Current pricing therefore anticipates a meaningful disconnect between the prospects for the CCC cohort as compared to the broader high yield market.

Differentiating within CCCs

Exhibit 4

| Corporate Rating | Security Rating | |

| Single-B | Higher Ranking Debt | Single-B or better (i.e. unchanged or notched up) |

| Lower Ranking Debt | CCC (notched down) | |

We would argue against a broad-brush ‘cohort’ approach to CCCs. Within the CCC universe there is a broad spectrum of credit quality. While some CCCs are the result of credit downgrades of underperforming businesses with unsustainable capital structures, others are of distinctly better credit quality, issued out of companies that have multiple tiers of debt in their capital structure.

Typically rating agencies ‘notch down’ lower ranking debt. Often single-B credit quality corporate issuers will have any lower ranking debt notched down to CCC – reflective of recovery rate rather than prospects of default.

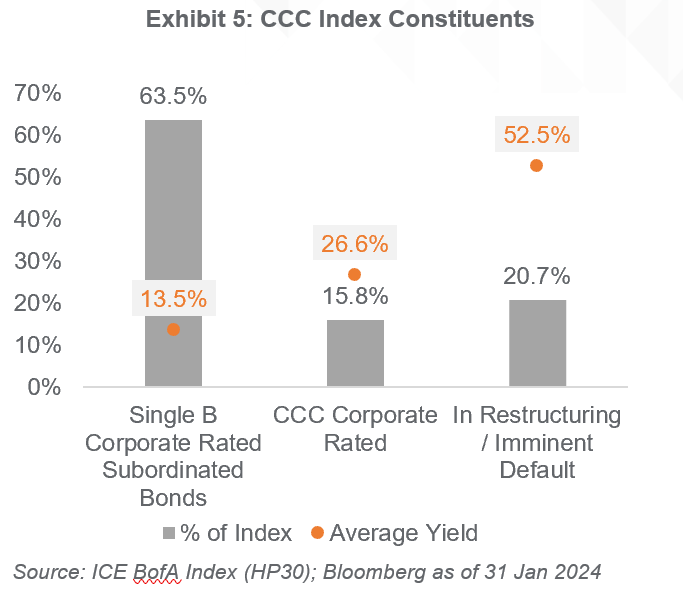

Broadly we can segment CCCs in the European High Yield Index into the following categories, as shown graphically in Exhibit 5, in order of decreasing credit quality:

- Notched down securities with a better corporate credit profile (Single-B or better);

- Securities where both the corporate credit profile and the security profile are CCC-rated; and

- Securities that have defaulted or are imminently expected to default – these securities are much more likely to trade on recovery value (cents on the dollar) where spreads become somewhat meaningless.

Which CCCs can be an attractive risk?

Applying the framework above and reviewing each security in the European high yield CCC universe, we can identify roughly two-thirds of the index as ‘higher credit quality’ (Single-B corporate rating) with lower risk of default. The remaining one-third of the index is made up of lower quality credits with higher risk of default.

The higher-quality issuers still offer a high return without undue risk – these instruments offer an average yield of 13%, which is significantly higher than Single-Bs. Simply buying the whole CCC universe would result in a yield uplift to 19%, however this would mean significantly increasing the risk of defaults within a portfolio.

Credit Case Study

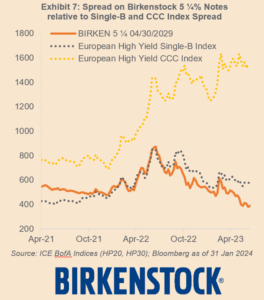

In February 2021, L Catterton acquired a majority stake in Birkenstock at a 17x Enterprise Value to EBITDA multiple. Birkenstock manufactures their iconic sandals from a manufacturing base in Germany. To support the acquisition, Birkenstock issued a senior secured EUR term loan (rated B by S&P) through 4.9x net leverage, and a EUR unsecured senior note (rated CCC by S&P) through 6.9x. Despite significant financial flexibility and valuation coverage, the rating agencies notched down the senior notes because of their relative size and low projected recovery in a default scenario.

Ultimately, Birkenstock de-levered rapidly from strong operating performance and cashflow generation and the market overlooked the CCC rating. In fact, the Birkenstock senior notes traded consistently tighter than most single-B rated securities. In July 2023 the notes were upgraded to B- and in November 2023, post-IPO, the issuer rating of Birkenstock was upgraded to BB-, with the notes remaining two notches lower at B.

The job of an investment manager is to identify the best relative value, adjusted for risk — where we are comfortable with the issuer’s competitive positioning, its exposure to the economic cycle, ability to generative positive free cashflow and the sustainability of its capital structure. Ultimately, we must be comfortable that the debt is serviceable and adequately covered from a valuation perspective. Once invested, it is critical to monitor the development of key risks and take appropriate and timely action if the trajectory on these key risks shifts negatively.

In summary, CCCs offer an outsized premium today relative to the history of the asset class. Whilst some of that premium may be required compensation for default losses, there is a significant degree of credit quality differentiation within the CCC cohort. Active and disciplined credit selection is key to delivering attractive risk adjusted returns, isolating the undesirable elements of the benchmark exposure. Hayfin’s current framework emphasises potential for CCCs to add value at market weight where the downside risks can be adequately quantified and managed.

For further information, please reach out to your primary relationship manager or to Investor Relations at IR@hayfin.com.

Sources:

1By the rating agencies, S&P and Moody’s.

2Data to 31 December 2023.

3CRP ranges based on Goldman Sachs estimates, see Goldman Sachs –Global Credit Trader – 8 Jun 23.

4Selected bonds include: Altice International, Banijay, Biogroup, Birkenstock (until upgrade 19/7/2023), Cerba, Foncia, Masmovil, Modulaire, Picard, SFR, TKE, Eviosys, T-Mobile NL, Verisure (until upgrade 15/5/2023), BMC, Ceramtec, Kantar, Kloeckner Pentaplast, Arxada, Merlin, Upfield, Solenis and Tui Cruises. Source: Bloomberg; ICE BAML Indices (HP30, HPS2).