Shipping is a critical component of downstream supply chains, transporting commodities and finished goods valued at over USD20 trillion in 2023.

A strategically important waterway, the Suez Canal (constructed in 1869), reduces travel distances meaningfully. The canal connects the Mediterranean Sea to the Red Sea with approximately 10% of global seaborne trade transiting the Suez Canal and hence the Red Sea.

Over the last few months, tensions in the Middle East have forced trade flow diversions to avoid the Red Sea. This has resulted in expanded tonne miles, increasing asset utilisation rates and has driven up charter rates and dividend yields.

Overview

Whilst Hayfin does not have vessels within its fleet which are scheduled to transit the Red Sea, and we retain the ability in our contracts to reject any request to trade these waters, we expect the current market dynamics of expanding tonne miles and elevated asset utilisation rates to be persistent forces over the medium to longer term.

By exploring the history, geography, and commercial impacts we can better understand real time developments and current and ongoing shift in market dynamics.

Over the last few months, tensions in the Middle East have forced trade flow diversions to avoid the Red Sea expanding tonne miles, increasing asset utilisation rates, and driving up charter rates and dividend yields.

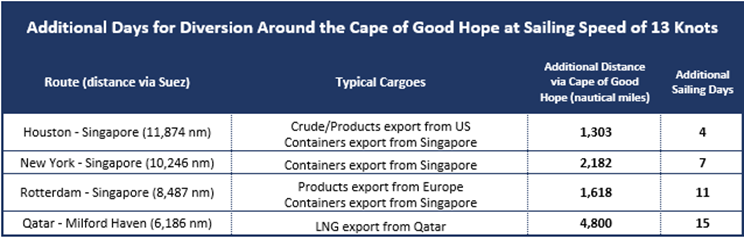

The table below illustrates increased sailing distances and voyage lengths for certain key routes.

At a sailing speed of 13 knots, diversions around the Cape of Good Hope can add up to 15 days in voyage duration, having a knock-on effect on charter rates, insurance premiums and fuel pricing/logistics.

- ‘War risk’ insurance premiums for Red Sea transits have risen by up to 10x.

- Availability of low sulphur fuel oil (‘LSFO’) at key bunkering hubs is a delicate balance; since mid-December 2023 pricing of LSFO in Durban, South Africa has increased 4.0x versus Rotterdam LSFO pricing.

Another consequence of recent disruption is that the proportion of Chinese owned ships transiting the Red Sea has increased significantly i.e. it is ‘western’ ships that are diverting around the Cape of Good Hope, further illustrating the impact of geopolitics in the conflict.

Geography

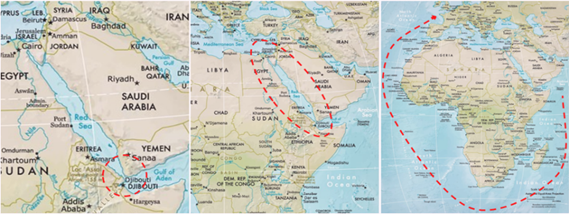

- Situated between the Arabian Peninsula and East Africa, the Red Sea provides access to Israel’s only port, Eliat, via the Gulf of Aqaba. At the southern end of the Red Sea lies the Bab-el- Mandeb Strait, bordered to the east by Yemen, and both Eritrea and Djibouti to the west.

- At its narrowest point, the Bab-el Mandeb Strait is just 21 miles wide, which is a similar width to the English Channel or approximately 20% of the distance between Florida and Cuba.

- Beyond the Red Sea, lies the Gulf of Aden, bordered by Yemen to the north and Somalia to the south.

Since the hijacking by Houthi militia of the Car Carrier Galaxy Leader (a vessel with links to Israel) on 19th November 2023 in a military operation involving the landing of heavily armed assailants aboard the vessel by helicopter, there have been around 30 attacks against ships transiting through the Red Sea. After what seemed to be an initial focus on vessels with links to Israel or simply calling at Israeli ports, the attacks have seemingly become increasingly sporadic and arbitrary, mostly against ships with no particular nexus to Israel.

As a result of these attacks, the United Nations Security Council has adopted Resolution 272 demanding the Houthis end their attacks and noting “the right of Member States, in accordance with international law, to defend their vessels from attacks.” Consequently, the US and its allies launched Operation Prosperity Guardian, deploying significant naval assets to the region, and launching a series of strikes against land-based targets in Yemen. In retaliation to these actions, the Houthis have shifted focus, attacking ships sailing in the Gulf of Aden off Yemen’s southern coast. This included a missile strike against the Gibraltar Eagle, a Bulk Carrier controlled by US- based Eagle Bulk Shipping, when it was located 90 miles southeast of Aden.

Commercial Impact

The threat posed by these attacks has forced diversions to avoid the Red Sea. Several shipping companies have publicly stated that they will no longer transit the Red Sea.

- It is estimated that since mid-December 2023, Containership arrivals in the Gulf of Arden have fallen 90%, Car Carriers 94%, Tankers 46%, Gas Carriers 86%, and Dry Bulk, least affected, at a 24% decline.

- These diversions also increase the complexity of voyage planning, particularly in terms of sourcing the availability of bunkers (ship fuel). Bunkering is available in South Africa, but supply is limited, and fuel costs are high. For example, as of 18 th January 2024, a metric tonne of LSFO cost USD537 in Rotterdam, USD600 in Singapore, and USD780 in Cape Town.

- The increase in tonne miles has in turn impacted the cost of freight. At the end of September 2023, the Shanghai Composite Containerised Freight Index (the barometer of the seaborne cost of shipping containers from China to global markets) settled at a post-pandemic low of 886.9. By the middle of November, it had risen to 1,000, and has since doubled, reaching 2,206 on 12th January 2024. In product tanker trades, we have seen evidence that spot rates for voyages that would usually pass through the Suez Canal have risen 30-50% since mid-December. Spot rates for long range and medium range product tankers have risen 33% and 29% respectively in the week ending 19th January 2024 alone.

- The southern reaches of the Red Sea have, for some time, been designated a “High Risk Area” for insurance purposes requiring ship owners to pay additional premium for transits. On 18th December 2023, the Joint War Committee at Lloyd’s of London extended the High-Risk Area from 15 degrees to 18 degrees, broadly to encompass the entire lower third of the Red Sea. War risk premiums for Red Sea transits have risen 10x from 0.075% – 0.125% in early December, to 0.5% – 0.75% of the hull value.

- There is also a human impact upon crew members forced to sail in the Red Sea. The crew of both the Galaxy Leader and the St. Nikolas, comprising Ukrainian, Bulgarian, Filipino, Greek, and Mexican nationals are still being held hostage.

Conclusion

Supply chains operate with delicate equilibriums, and delays or disruption tend to increase pricing, benefiting ship owners but perpetuating commodity price inflation.

We have experienced these dynamics several times recently with the trade disruptions during the Covid 19 period, the Suez Canal blockage in 2021 due to the Ever Given, the drought implications in the Panama Canal and the profound impact of shifting energy flows due to the Russia/Ukraine conflict.

The current market dynamics are no different. Since Q4 we have seen increases in the Shanghai Composite Containerised Freight Index by 2.5x. In the same period spot rates on certain refined product tanker trades have increased by up to 50%.

Unlike fixed physical infrastructure, m aritime assets are liquid and dynamic. This is evidenced by shifting trade flows away from the Red Sea and the Suez Canal, instead taking the long route around the Cape of Good Hope as those with interest in ships seek to protect their crews, assets, and cargoes. This drives up freight costs and tightens shipping markets due to increased tonne mile demand.

Persistent trade flow disruptions and expanding ton miles are expected to remain a more permanent feature within supply chains and these market dynamics, on top of healthy long term demand fundamentals, are expected to exacerbate supply/demand imbalances and could likely lead to sharper or longer periods of elevated rates and higher asset yields. When considering these fundamentals against portfolio construction considerations, staggered duration charter contracts across a diversified hard asset base as well as “index-linked” or profit share structures are well positioned to capture these gains and dividend streams.

The kind of interruption to maritime trade that we are currently seeing in the Red Sea has a wide range of ramifications. This includes, first and foremost, the crew members and civilians endangered or otherwise directly impacted by the instability in the region. It also affects consumers and businesses in the form of higher commodity prices and freight costs. But for shipowners and other maritime investors, supply chain disruption can drive up rates and therefore boost yields. This combination of favourable pricing dynamics and a more challenging operating environment looks set to remain a feature of the shipping industry in the medium to long term – layered on top of a longstanding and fundamental supply -demand imbalance that is the primary driver of investor interest in the shipping market.

Hayfin today announces the continued expansion of its global presence having received in-principle approval to open a new representative office in the Dubai International Financial Centre (“DIFC”)*. Through this opening, Hayfin will strengthen its footprint in the Middle East and North Africa (MENA) region.

The expansion underscores the firm’s commitment to growing strategically, following the opening of the Tokyo office at the end of 2023. With an established local presence, Hayfin is set to enhance its coverage in the UAE and Middle Eastern markets and consolidate local investor relationships.

The opening of the DIFC office increases Hayfin’s total number of locations to 13 alongside the firm’s headquarters in London and offices in Frankfurt, Madrid, Milan, Munich, New York, Paris, Luxembourg, San Diego, Singapore, Stockholm and Tokyo. Jack Richardson, Principal, Partner Solutions will be permanently based in the DIFC office and will work under the guidance of Camilla Coriani, Managing Director, Partner Solutions who will oversee efforts in the region.

Alex Wolfman, Global Head of Partner Solutions at Hayfin, said: “The DIFC representative office will form a crucial part of Hayfin’s Partner Solutions approach. The combination of our scale, global footprint as well as depth and breadth of our existing relationships is a solid foundation for us to grow within the region.”

*The Dubai Financial Services Authority approval is subject to Hayfin fulfilling criteria within a six-month period.

Hayfin today announces that it has completed a fundraising process for its Maritime Yield strategy. Having attracted c.$400m in capital commitments for the fund, Hayfin will have the capacity to acquire up to $1bn of shipping assets when coupled with conservative debt financing.

Through the Maritime Yield strategy, Hayfin will invest across each of the industrial maritime sectors, with a focus on acquiring top-specification assets that generate predictable and uncorrelated cash yields from blue-chip counterparties.

Hayfin maintains a discrete profile but has a sizeable Maritime industry footprint with continuous investment activity across direct lending, alternative credit, leasing, and ship ownership, complete with an in-house ship management platform, Greenheart Shipping. This latest fundraising round is a further extension of its track record in the maritime sector, having invested in excess of $3 billion across the various sectors – dry bulk, tankers, containers, LPG, and LNG. The Maritime Yield strategy received strong support from a diverse group of both new and existing investors including leading insurance companies, pension funds, family offices, and infrastructure funds.

Andreas Povlsen, Head of Maritime, commented: “This latest pocket of capital dedicated to the maritime industry is a powerful complement to our existing capabilities. Having acquired more than 80 vessels and concluded more than $1bn of charter revenues, we continue to execute on our strategy of generating strong risk-weighted returns from a quality hard-asset base. Our strategy in maritime focuses on aligning patient institutional capital with attractive fuel-efficient assets and predictable as well as diversified cash yields generated from investment-grade counterparties.”

Nino Mowinckel, Managing Director, Maritime Funds at Hayfin, stated: “Shipping markets are undergoing a period of profound structural change with rising barriers to entry, constrained supply-side dynamics, expanding tonne miles, and tightening regulatory regimes that will increase asset utilisation rates over time. We believe that the industry continues to benefit from adopting a more institutional, value-add infrastructure model, transitioning away from short-termism and sub-scale platforms.”

Njord and Greenheart, a subsidiary of Hayfin Capital Management, have added an extra vessel to their thriving partnership. Njord will design and install a bespoke package of energy-saving devices on the recently bought capesize bulk carrier (to be renamed GH NIGHTINGALE) to boost its performance and commercial tradability. The package will consist of a bespoke combination of technologies, chosen from Njord’s portfolio of more than 30 technologies. They will be installed in dry dock in early 2024, aiming to achieve fuel and emission cuts of between 7 and 16%.

“At Greenheart, improving the performance of our fleet is an integral part of our strategy and so we put each of our vessels on a specific enhancement plan,” says Nikos Benetis, Technical Director at Greenheart Management. “We are pleased that Njord is again able to support us in creating a strong business case for this retrofit. At a time where demand for energy efficiency solutions is high, Njord is able to provide us with very short lead times on buying the energy-saving technology, so we will be able to boost the vessel’s performance and provide an excellent service to our clients from day one. We view our relationship with Njord as a real constructive and trusted partnership.”

The work on GH Nightingale is a continuation of the collaboration between the parties that began in April 2023 when Njord and Greenheart entered into partnership together, along with maritime consulting firm Marsoft. Since then, Njord has designed bespoke packages of fuel-saving technologies for four Greenheart-owned vessels. The scope of the partnership now extends to five vessels, including GH Nightingale. Once the technology is installed, Marsoft will quantify and certify the CO2 savings through carbon credits, ensuring Greenheart is able to optimise the financial value of the fuel savings.

Once the technology is installed, Marsoft will quantify and certify the CO2 savings through carbon credits, ensuring Greenheart is able to optimise the financial value of the fuel savings.

New York – October 26, 2023 – Hayfin Capital Management (“Hayfin”), a leading alternative asset management firm, announces today the expansion of its liquid credit team through the appointment of Peter Swanson as Senior Portfolio Manager and Head of US High-Yield and Syndicated Loans. Peter will be based in New York.

Peter joins Hayfin from Intermediate Capital Group (ICG) where he served as a Portfolio Manager and a Senior Trader investing in syndicated loans and high-yield bonds in CLO and long-only formats. Prior to this, Peter was a Trader at BMO Capital Markets, working on the Leveraged Finance Distribution and Trading team. He brings over a decade of industry experience to the role and will lead the High-Yield & Syndicated Loans team in New York.

Hayfin invests in North American liquid credit assets through its US CLO platform, which manages $2.8bn in AUM across six vehicles. The firm’s US market coverage is complemented by its European High-Yield & Syndicated Loans strategy led by Gina Germano in London.

Peter Swanson, said: “I am excited to join Hayfin at a time when there are attractive return potentials available in North American high-yield credit for those able to navigate uncertain market conditions. The firm has built a high-quality team and a historically robust US CLO platform. I look forward to helping to build on that strong foundation.”

Tim Flynn, Co-founder and Chief Executive Officer at Hayfin, said: “I’m pleased to welcome Peter to the team. His industry experience combined with Hayfin’s dynamic approach in creating effective capital solutions across the credit spectrum puts the firm in a great position. The US remains a critical market with significant opportunities and we have built a great team to capitalize on that.”

Ends

Notes to Editor

About Hayfin Capital Management

Founded in 2009, Hayfin Capital Management (“Hayfin”) is a leading alternative asset management firm with c. €31 billion in assets under management. Hayfin focuses on delivering attractive risk-adjusted returns for its investors across its private debt, liquid credit and private equity solutions businesses.

Hayfin has a diverse international team of over 200 experienced industry professionals with offices globally, including headquarters in London and offices in Frankfurt, Munich, Madrid, Milan, Paris, Luxembourg, Stockholm, New York, San Diego, Singapore and Tokyo.

Further information can be found at hayfin.com.

Contacts:

Hawthorn Advisors: +44 (0)7858 373930

James Davey hayfin@hawthornadvisors.com

London, 18 August 2023 – Hayfin Capital Management (“Hayfin”), a leading alternative asset management firm, today announces that it has attracted capital commitments in excess of its €6 billion target for Hayfin Direct Lending Fund IV. The successful fundraise comprised the commingled Fund IV, which has reached a final close, and certain related investment vehicles. Hayfin expects total available capital to be at or near the strategy’s hard cap of €7 billion by the end of the year.

Through its Direct Lending strategy, Hayfin originates, structures and invests in performing senior-secured loans, primarily to European middle-market and upper-middle-market companies, with an emphasis on downside protection. Investing throughout the credit cycle, Hayfin self-originates primary investment opportunities through its local sourcing teams across 12 offices globally and its sector-specialist teams, as well as opportunistically acquiring attractively priced senior loans in the secondary market. With banks reducing their risk appetite and new issuance levels in the leveraged finance market remaining weak since early 2022, Hayfin believes Fund IV is well-positioned to meet substantial demand for private credit solutions and to continue to invest in high-quality borrowers on attractive terms.

This latest fundraise attracted capital commitments from a broad range of institutional investors globally, including both new and existing LPs, comprising public and private pension funds, financial institutions, insurance companies, sovereign wealth funds, funds of funds, endowments, consultants and family offices. It represents Hayfin’s record fundraise for its flagship private credit strategy and the firm’s largest capital-raise to date, exceeding the c. €5 billion raised for the previous vintage of the Direct Lending strategy in 2020.

Tim Flynn, Chief Executive Officer and Co-Founder of Hayfin, commented: “We are delighted to have achieved this successful fundraise for the latest vintage of our Direct Lending strategy against a challenging macroeconomic backdrop. Our investors have signalled their strong belief in our well-resourced and specialist team, our diverse origination model and our robust track record of disciplined lending and capital preservation, and we are grateful for their continued trust.

“Hayfin was founded in 2009, in the aftermath of the global financial crisis, which saw traditional banks’ appetite for corporate lending recede sharply. The recent market dislocation and the sluggish recovery of the leveraged finance market presents another attractive environment for Hayfin to deploy capital into both mid-market and upper-mid-market financings. We believe that we remain well positioned to meet borrowers’ demand for private credit solutions on terms that offer strong risk-adjusted returns to our clients.”

Hayfin was advised on the fundraise by Macfarlanes.

Since it was founded in 2009, Hayfin has invested over €35 billion of capital across more than 470 portfolio companies via its private credit strategies.

Hayfin today announces the continued growth of its client coverage expertise through the appointment of Steve Bringardner, CFA, as Head of Consultant Relations within the Partner Solutions team. Steve will be based Chicago.

The expansion of the Partner Solutions team enables Hayfin to continue to strengthen relationships and meaningfully engage with its current and prospective investors to deeply understand their needs. Steve represents the most recent senior addition to Hayfin’s client coverage team, which now totals 25 highly experienced professionals globally, providing clients with tailored investment solutions within the alternatives space.

Steve joins Hayfin from BlackRock, where he spent over 12 years as Managing Director within the Global Consultant Relations team. Prior to this, Steve was a member of the team responsible for institutional client and consultant coverage at AllianceBernstein, based in Chicago. Steve brings over 15 years of experience in building relationships with investment consultants across public and private asset classes.

Alexander Wolfman, Global Head of Partner Solutions at Hayfin, commented: “We are delighted to welcome Steve to Hayfin. Consultant coverage represents an incredibly important investment channel for Hayfin and accounts for an ever-increasing share of our global investor base. Steve’s extensive relationships with a range of investment consultants and institutional investors globally will further strengthen our ability to communicate and offer thoughtful investment solutions to both existing and prospective clients.”

Steve Bringardner, CFA, Head of Consultant Relations in the Partner Solutions team at Hayfin, said: “I’m excited to be joining the Partner Solutions team at Hayfin. The firm stands apart from others in the industry due to its longstanding heritage of generating best-in-class returns for investors throughout market cycles. Hayfin’s innovative and dynamic approach in creating intelligent capital solutions, across the credit spectrum, has established a differentiated platform that aligns with our clients’ long-term objectives. I look forward to supporting Hayfin’s diverse relationship and investor base as we continue to grow the firm’s global footprint.”

Hayfin today announces the expansion of its client coverage capabilities in German-speaking Europe through the appointment of Marco Sedlmayr as Head of DACH within the Partner Solutions team. Marco will be based in Munich.

Marco joins Hayfin from Golding Capital Partners, where he spent five years as Managing Director and Head of Institutional Clients in Germany and Austria. Prior to this, Marco worked at Allianz Global Investors as Practice Leader in the DACH re-gion within the Insurance Business Development EMEA Group. Before this role, Marco was a Senior Business Development Manager at Crédit Agricole Group and J.P. Morgan.

This senior hire strengthens Hayfin’s proven ability to provide high-quality client ser-vice to its established investor base in the DACH region. It signals Hayfin’s contin-ued commitment to building a team that has a deep understanding of its clients’ needs and to delivering tailored, thoughtful investment solutions within the alterna-tives space for investors around the world.

Alexander Wolfman, Global Head of Partner Solutions at Hayfin, commented: “Last year we grew our AUM to over €29 billion, with our flagship private debt strategies accounting for two thirds of that. The DACH region has been an important part of Hayfin’s growth story and Marco’s appointment will help us maintain our high stand-ards of client coverage as we continue to grow the business within the region. With his extensive experience working with a range of institutional investors and breadth of relationships across German-speaking Europe, we are delighted to welcome him to Hayfin.”

Marco Sedlmayr, Head of DACH in the Partner Solutions team at Hayfin, said: “I’m excited to be joining Hayfin. The firm’s impressive private credit platform, in combi-nation with its continued growth and best-in-class returns for investors, distinguishes it as a leading player in the market. Now having local presence in Munich is a clear commitment to the German-speaking market and will help to strengthen our existing client relationships and further grow our business in the DACH region.”

Hayfin Capital Management today announces the pricing of Hayfin Emerald CLO X (“Emerald X”), a €450-million Collateralised Loan Obligation (“CLO”) and the tenth new-issue deal completed by Hayfin’s European CLO platform since August 2018. It follows the pricing of the €392.8m Hayfin Emerald IX CLO in March 2022.

Consistent with Hayfin’s previous European CLOs backed by broadly syndicated loans, Emerald X will invest in a diversified portfolio of European senior-secured loans and bonds. The structure once again attracted strong investor demand and was oversubscribed in all classes of notes.

Gina Germano, Portfolio Manager and Head of the European High-Yield & Syndicated Loans investment team, said: “It’s pleasing to have completed the tenth new issuance of our European platform which was established four years ago. The deal is testament to our team’s success in delivering a sustained period of excellent performance across our CLO portfolio on behalf of our investors.

“The strong demand for this deal following a period of challenging market conditions for new CLO prints underlines our status as one of Europe’s leading high-yield credit managers. Despite the mounting macroeconomic headwinds, including a rising interest rate environment and sustained inflationary pressures, we feel well placed to further differentiate ourselves through diligent credit selection, focus on research-driven processes and active portfolio management.”

Hayfin’s High-Yield & Syndicated Loans investment team won the High Yield Fund award at the 2021 AltCredit European Performance and Services Awards.

Jefferies acted as arranger for the transaction.

Hayfin today announces that it has successfully become a signatory to the FRC’s UK Stewardship Code 2020. The UK Stewardship Code sets a standard for best practice for asset managers investing on behalf of UK asset owners. Further details about the Code can be found on the Financial Reporting Council’s website here.

In Hayfin’s submission report, which can be read in full here, the firm articulates how it has invested over the course of the 12-month period ending 30th April 2021 in line with the 12 Principles set out for asset managers in the Code. Over this period, Hayfin continued to enhance its responsible investment efforts internally, prioritising improved disclosure of its responsible investment approach and outcomes, while listening to the requirements of its investors in guiding how it could best act as stewards of its clients’ assets.

Tim Flynn, CEO of Hayfin, said: “Whilst we are delighted to have gained signatory status, Hayfin is alive to the need to stay ahead of the ever-expanding needs of our clients in the areas of stewardship and responsible investing. We will continue to seek opportunities to strengthen our actions and policies wherever possible.”