Hayfin announces the pricing of Hayfin Emerald CLO XIII (“Emerald XIII”), a €405.7 million Collateralised Loan Obligation (“CLO”).

Hayfin’s first European issuance of 2024 follows last year’s prints of Emerald CLO XII in November 2023 and Emerald CLO XI in January 2023. The transaction increases the AUM of Hayfin’s European CLO platform to more than €5.5 billion.

Like Hayfin’s previous CLOs in the Emerald series, Emerald XIII will invest in a diversified portfolio of European senior-secured loans and bonds. Hayfin secured a leading Japanese institutional allocator as anchor investor in the transaction with a preplacement of the AAA tranche. The strength of demand for Emerald XIII, from both new and existing investors in Hayfin’s European CLO platform, was further reflected in tight pricing achieved at all levels of the capital structure and the accelerated timeframe within which the transaction was executed.

Gina Germano, Hayfin Head of European High-Yield & Syndicated Loans, commented: “We believe this transaction emphasises our position as one of Europe’s leading and best-established high-yield credit managers. Our ability to lock in a blue-chip Japanese anchor investor in only six weeks, following a competitive process conducted prior to the launch of the deal, provides a strong foundation for our platform to establish future partnerships in this strategically important market. The competitive spreads at which the remaining notes priced reflects the confidence of both first-time and returning investors in our track record of credit selection and portfolio management.”

Hayfin today announces that it has arranged the debt financing of Eurazeo’s acquisition of Eres Group (“Eres”), a French employee savings distribution platform. Hayfin’s support for the acquisition extends its relationship with Eres, having been a lender to the business since IK Partners’ acquisition of Eres in 2019.

Established in 2005, Eres is the leading French independent player in the advisory and structuring, asset management and distribution of employee profit sharing plans (PEE, PERECO), retirement schemes (PER) and employee shareholding plans. Headquartered in Paris, Eres distributes its products through a network of more than 6,600 distributors (wealth management advisors, insurance brokers, accountants) and directly addresses mid-sized companies and large groups.

Clement Le Lagadec, Hayfin Director for Private Credit in France, commented: “Thanks to its strong knowledge of the company and its management, Hayfin has been able to quickly position itself as a lead lender in this highly competitive process. In this vein, we are delighted to support Eurazeo in the financing of this transaction. We have been impressed by Eres’ performance over the past five years and are excited to continue our journey with the company alongside its management and its new private equity partner Eurazeo.”

Disclaimer: Past performance is not a guarantee of future performance. No investment, strategy or tested process can guarantee results. Please note, fees reduce returns to investors.

In recognition of International Women’s Day, Hayfin’s Global Women’s Initiative hosted a panel discussion centred around the theme of Empowerment.

The event was moderated by Gina Germano, Portfolio Manager and Head of Europe High-Yield & Syndicated Loans at Hayfin, and attended by guest speakers: Erika Tikka, Head of External Fixed Income at Keva; Laura Coady, Head of European Securitised Markets Group at Jefferies; and Marieke Van Dijk-Van Kamp, Head of Private Markets at NN. The women shared their career experiences in both the UK and Europe, reflected on progress made to date, and discussed what more can be done to facilitate an inclusive workplace to better attract and retain female talent across all levels of seniority.

For further insights, watch the panel discussion in full below.

Hayfin co-founder and CEO Tim Flynn was featured on Private Market Talks providing insight into the Hayfin team’s dynamic, innovative approach to direct lending and leveraged finance. Tim reflected on learnings from his career journey, from starting out as a beekeeper to founding a leading European alternative asset management firm, and how he applies the learnings from each experience to continue to enhance the Hayfin business. He also provides a view on the opportunities and challenges he sees within the private markets, and how these are informing Hayfin’s strategy.

Hayfin today announces that it has participated in the financing to support Bridgepoint’s acquisition of French residential property management services company Nexity ADB from its parent company Nexity Group.

Nexity Group is France’s largest publicly listed real estate developer. The carve-out of the residential property management services division will provide Nexity ADB with a stronger platform to grow the business as a standalone company.

Alban Senlis, Head of Hayfin Private Credit in France, commented: “We are pleased to be partnered with Bridgepoint, who have deep expertise and an outstanding track record in the sector. This is a highly attractive investment to Hayfin given the company’s solid and resilient trading performance, as well as its potential for further growth as an independent business with the right level of funding behind it. We look forward to working with our new partners as Nexity ABD embarks on its next phase of growth.”

Disclaimer: Past performance is not a guarantee of future performance. No investment, strategy or tested process can guarantee results. Please note, fees reduce returns to investors.

Hayfin today announces that it has appointed Michaela Campbell as a Managing Director in its Private Credit team.

Michaela will be responsible for overseeing the team’s portfolio monitoring and risk profile across new and existing investments. She will be based in Hayfin’s headquarters in London and work closely with Portfolio Manager and Co-Head of Direct Lending, Mark Bickerstaffe and Portfolio Manager and Co-Head of Direct Lending, Marc Chowrimootoo.

Michaela’s appointment comes as Hayfin continues to deploy significant capital through its flagship private credit strategy, having last year exceeded its €6 billion target fundraise for Hayfin Direct Lending Fund IV. Recent investments across Hayfin’s private credit strategies include loans supporting IK Partners’ acquisition of French fire safety company Eurofeu Group and Näder Holdings’ repurchase of a minority stake in leading global orthotics company Ottobock.

Prior to joining Hayfin, Michaela spent five years at BlackRock in the Risk and Quantitative Analytics team and most recently served as co-head of global investment risk for Private Credit and Private Equity. Before joining BlackRock, she worked at GE Capital for more than a decade, where she held several roles in London and Abu Dhabi with a focus on underwriting, portfolio management and restructuring of leveraged loans. She earned a BSc degree in statistics and actuarial science from the University of the Witwatersrand in Johannesburg and is a CFA Charter holder.

Mark Bickerstaffe said: “We are delighted to welcome Michaela to Hayfin as a new Managing Director in the private credit team. She brings with her a wealth of directly transferable skills and insight from her previous roles. Michaela joins Hayfin at an exciting time as we look to capitalise on the recent increase of institutional asset allocation towards private credit in Europe and build on our recent private financing success across the continent. Establishing a specialised portfolio monitoring team is an important step for us as we continue to grow the capacity and ambition of our Private Credit strategy.”

Michaela Campbell said: “Hayfin has experienced remarkable growth in recent years and has consistently proven that it can deploy capital at scale and at speed, whilst maintaining a conservative risk profile. Its unparalleled network and connections across the European market are equally impressive. I look forward to working alongside my new colleagues and industry partners across Hayfin’s Private Credit strategy.”

Hayfin’s core private credit strategies comprise Direct Lending, through which Hayfin invests in performing loans to primarily European middle-market companies; Tactical Solutions in which the firm has a flexible mandate to pursue opportunistic investments with credit-like risk profiles at enhanced returns; and Special Opportunities, where it invests flexibly in a range of unique opportunities across industries, markets and sub-strategies in situations where financing may be scarce.

Disclaimer: Past affiliations are not a reflection of current capabilities and past performance is not an indication of future results.

Within the European private equity secondaries market, single-asset GP-led transactions are anticipated to double, if not triple, in volume in the next three to five years. Hayfin’s Mirja Lehmler-Brown sits down with Private Equity International to discuss the attractive dynamics within the current market, as well as its expected evolution over the coming years.

Read the full commentary below.

Hayfin today announces that it has acted as the provider of senior-secured debt financing to support IK Partners’ acquisition of French fire safety company Eurofeu Group (“Eurofeu”) from CAPZA.

Founded in 1972, Eurofeu installs and maintains fire protection equipment, as well as fire protection systems, for business-to-business (B2B) clients predominantly. Eurofeu’s integrated manufacturing capabilities enable the company to provide a highly differentiated offering from its competitors. It benefits from strong product sale revenues as well as generating additional income from the maintenance of existing fire protection equipment and the supply of associated spare parts.

Eurofeu employs 1.850 workers across 42 agencies and two manufacturing sites, serving approximately 160,000 B2B clients across France.

Alban Senlis, Head of Hayfin Private Credit in France, commented: “We are delighted to have partnered with the Eurofeu management team and prominent private equity sponsor IK Partners to underwrite this debt financing, providing the flexibility, certainty and speed of execution to enable this significant acquisition. We look forward to working closely with IK Partners and Eurofeu throughout the next chapter of the company’s growth journey.”

The debt financing brings the firm’s total investment activity in France through its Direct Lending strategy to c. €3 billion deployed across more than 20 transactions in the past 5 years.

Summary

- CCC bonds are at the bottom of the high yield ratings spectrum. Comprising only 5-6% of the relevant European indices, in widening markets, CCCs tend to absorb much of the price dispersion.

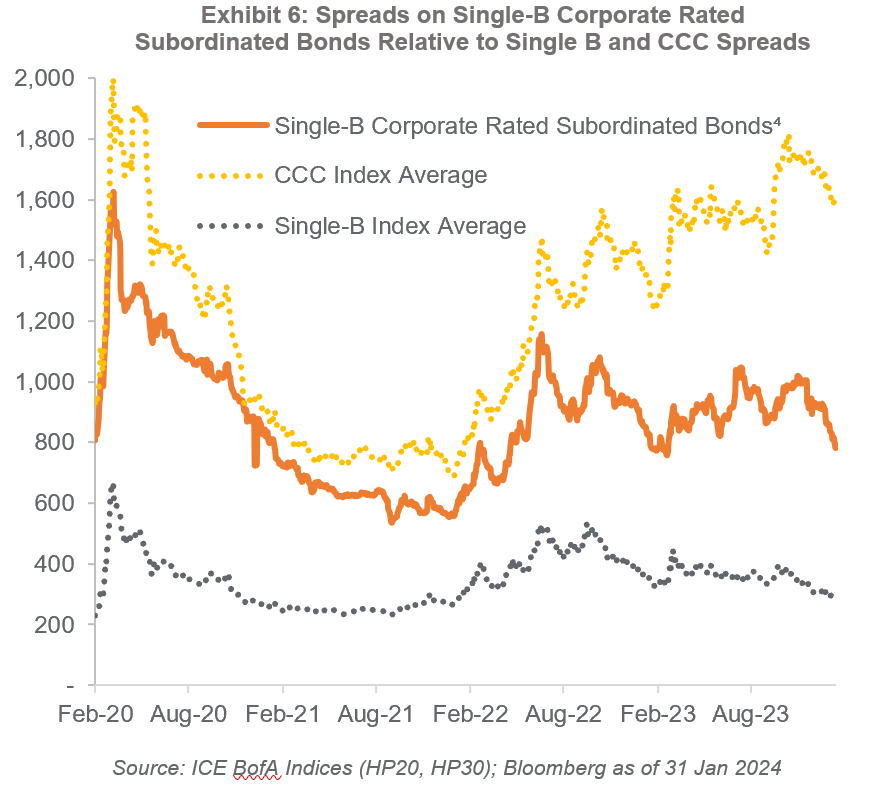

- Over the last decade, credit markets have been largely undifferentiated, and European high yield CCCs have not offered good risk reward. However, at current market pricing CCCs offer a yield-to-maturity of 19% and trade at an historically wide premium of more than 1,000 basis points over the single-B credit index.

- Credit ratings are driven by two factors – probability of default and expected recoveries. Within the European CCC universe, Hayfin focuses on the roughly two-thirds of CCC instruments that it believes carry a lower default probability and may offer meaningful positive price convexity.

- Portfolio construction at Hayfin is driven by high conviction and not by benchmark composition. We select securities idiosyncratically, based on sector, credit quality, and price and apply a detailed investment process – combining bottom credit analysis and an active and flexible portfolio framework; thus allowing us to extract interesting risk-adjusted returns within speculatively-rated credit categories.

Corporate bonds and loans rated CCC by S&P or Caa by Moody’s (together “CCCs”) are the lowest rung on the credit quality scale — just above default — and represent high non-payment risk. The rating factors “both the likelihood of default and any financial loss suffered” and is indicative of vulnerability to any adverse conditions1. CCCs today only represent around 5-6% of the European Leveraged Loan and European High Yield Bond indices and are therefore not a core part of the investment universe — furthermore, credit managers may actively aim to minimise exposure to CCCs as part of downside avoidance.

CCCs – a history

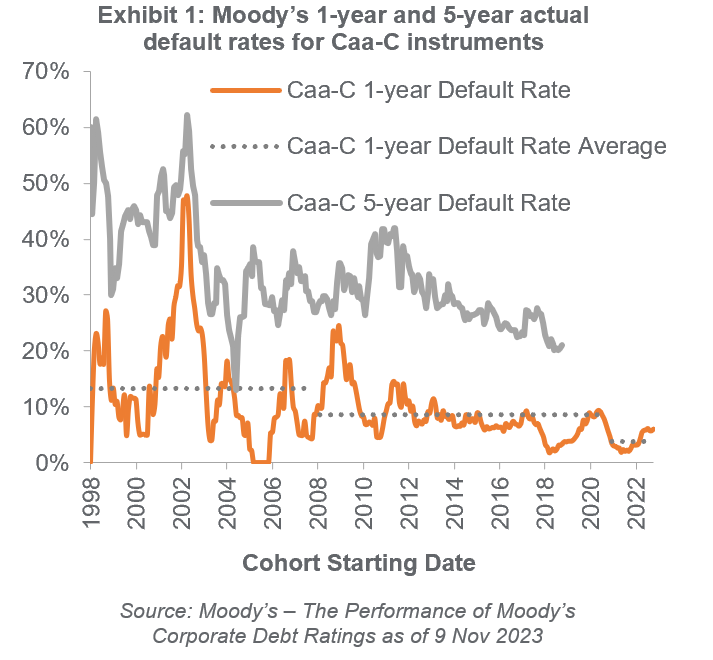

Historically, a large proportion of CCC rated issuers had poor financial or operational momentum which resulted in downgrades from single B to CCC and then default relatively soon after. The complexion of the CCC universe is now markedly different — many CCC instruments have been assigned that rating at issuance rather than being downgraded due to underperformance. This has resulted in a lower default rate for CCCs in the post-Global Financial Crisis era. From 1998-2007, 37% of CCC rated instruments would default within any 5-year period, with peaks of 60% during the Asian financial crisis and the dotcom bubble, and 40% during the Global Financial Crisis and the European Sovereign Crisis. Over the last 5 years that default rate is meaningfully lower at 21%. Similarly, between 1998 and 2007, 13% of CCCs would default in any given 1-year period compared to an average of just 3.7% over the last 24 months.

What is the CCC value proposition today?

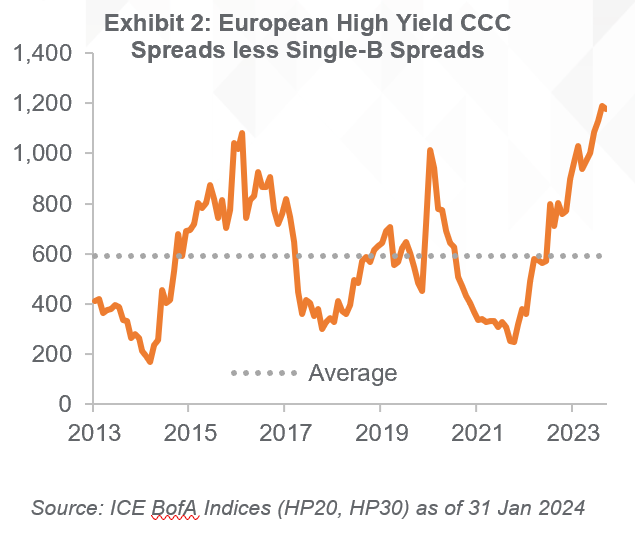

Over the past 10-years2, European CCC high yield as a cohort has delivered an annualised return of 3.0% — below the broader high yield index of 3.5% and the BB-B ratings categories, which have returned 3.6%. Adjusted for volatility, CCCs look even less compelling from an asset allocation point of view. However, the CCC performance differential widened through 2023 and today CCCs are priced at an historically large premium to the rest of the asset class. CCC high yield trades at a spread of 1,600 basis points (bps), which is an unprecedented 1,000 bps premium over Single-B rated high yield — well above the 10-year average spread differential of 592 bps. CCC yield-to-maturity of 19% compares to the broader market at 7%.

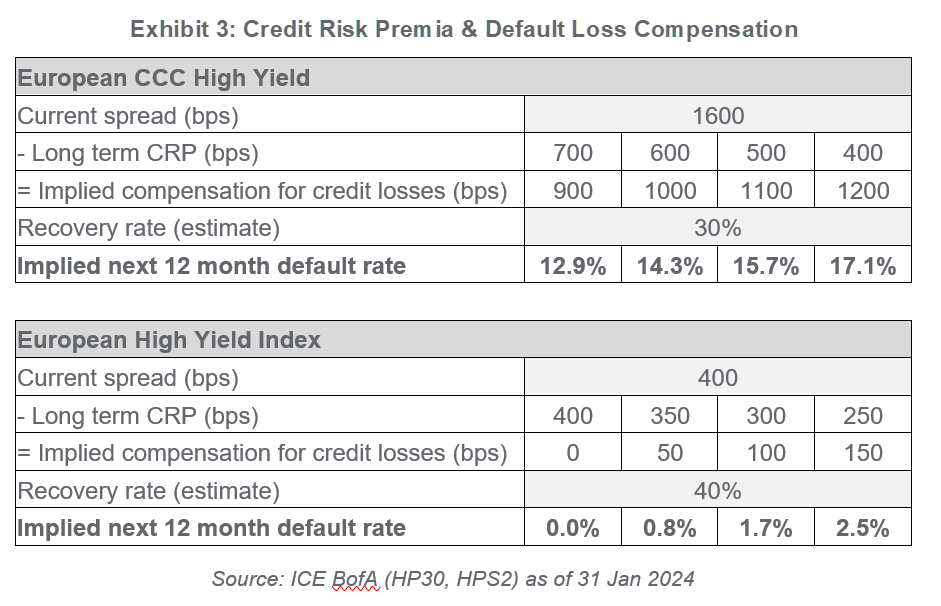

The outsized premium for CCCs today warrants the question: is this a compelling time to invest in CCCs, or are we simply being compensated for elevated default losses ahead?

Taking a range of estimates for the long-term credit risk premium (CRP)3 and an assumption on recovery rates, we can impute the compensation for default losses and solve for the default rate priced by the market. Current pricing for CCCs implies a 1-year default rate percentage in the mid-teens, which is much more in line with pre-GFC levels. In contrast, broader high yield index pricing currently implies a low single digit default rate. Current pricing therefore anticipates a meaningful disconnect between the prospects for the CCC cohort as compared to the broader high yield market.

Differentiating within CCCs

Exhibit 4

| Corporate Rating | Security Rating | |

| Single-B | Higher Ranking Debt | Single-B or better (i.e. unchanged or notched up) |

| Lower Ranking Debt | CCC (notched down) | |

We would argue against a broad-brush ‘cohort’ approach to CCCs. Within the CCC universe there is a broad spectrum of credit quality. While some CCCs are the result of credit downgrades of underperforming businesses with unsustainable capital structures, others are of distinctly better credit quality, issued out of companies that have multiple tiers of debt in their capital structure.

Typically rating agencies ‘notch down’ lower ranking debt. Often single-B credit quality corporate issuers will have any lower ranking debt notched down to CCC – reflective of recovery rate rather than prospects of default.

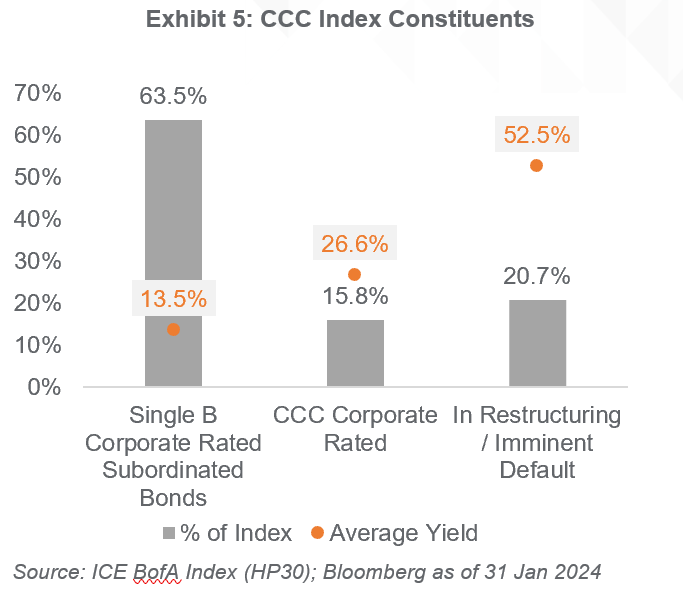

Broadly we can segment CCCs in the European High Yield Index into the following categories, as shown graphically in Exhibit 5, in order of decreasing credit quality:

- Notched down securities with a better corporate credit profile (Single-B or better);

- Securities where both the corporate credit profile and the security profile are CCC-rated; and

- Securities that have defaulted or are imminently expected to default – these securities are much more likely to trade on recovery value (cents on the dollar) where spreads become somewhat meaningless.

Which CCCs can be an attractive risk?

Applying the framework above and reviewing each security in the European high yield CCC universe, we can identify roughly two-thirds of the index as ‘higher credit quality’ (Single-B corporate rating) with lower risk of default. The remaining one-third of the index is made up of lower quality credits with higher risk of default.

The higher-quality issuers still offer a high return without undue risk – these instruments offer an average yield of 13%, which is significantly higher than Single-Bs. Simply buying the whole CCC universe would result in a yield uplift to 19%, however this would mean significantly increasing the risk of defaults within a portfolio.

Credit Case Study

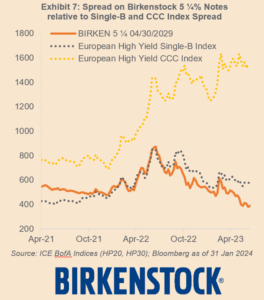

In February 2021, L Catterton acquired a majority stake in Birkenstock at a 17x Enterprise Value to EBITDA multiple. Birkenstock manufactures their iconic sandals from a manufacturing base in Germany. To support the acquisition, Birkenstock issued a senior secured EUR term loan (rated B by S&P) through 4.9x net leverage, and a EUR unsecured senior note (rated CCC by S&P) through 6.9x. Despite significant financial flexibility and valuation coverage, the rating agencies notched down the senior notes because of their relative size and low projected recovery in a default scenario.

Ultimately, Birkenstock de-levered rapidly from strong operating performance and cashflow generation and the market overlooked the CCC rating. In fact, the Birkenstock senior notes traded consistently tighter than most single-B rated securities. In July 2023 the notes were upgraded to B- and in November 2023, post-IPO, the issuer rating of Birkenstock was upgraded to BB-, with the notes remaining two notches lower at B.

The job of an investment manager is to identify the best relative value, adjusted for risk — where we are comfortable with the issuer’s competitive positioning, its exposure to the economic cycle, ability to generative positive free cashflow and the sustainability of its capital structure. Ultimately, we must be comfortable that the debt is serviceable and adequately covered from a valuation perspective. Once invested, it is critical to monitor the development of key risks and take appropriate and timely action if the trajectory on these key risks shifts negatively.

In summary, CCCs offer an outsized premium today relative to the history of the asset class. Whilst some of that premium may be required compensation for default losses, there is a significant degree of credit quality differentiation within the CCC cohort. Active and disciplined credit selection is key to delivering attractive risk adjusted returns, isolating the undesirable elements of the benchmark exposure. Hayfin’s current framework emphasises potential for CCCs to add value at market weight where the downside risks can be adequately quantified and managed.

For further information, please reach out to your primary relationship manager or to Investor Relations at IR@hayfin.com.

Sources:

1By the rating agencies, S&P and Moody’s.

2Data to 31 December 2023.

3CRP ranges based on Goldman Sachs estimates, see Goldman Sachs –Global Credit Trader – 8 Jun 23.

4Selected bonds include: Altice International, Banijay, Biogroup, Birkenstock (until upgrade 19/7/2023), Cerba, Foncia, Masmovil, Modulaire, Picard, SFR, TKE, Eviosys, T-Mobile NL, Verisure (until upgrade 15/5/2023), BMC, Ceramtec, Kantar, Kloeckner Pentaplast, Arxada, Merlin, Upfield, Solenis and Tui Cruises. Source: Bloomberg; ICE BAML Indices (HP30, HPS2).

Hayfin today announces that it has signed a contract with Oshima Shipbuilding and Sumisho Marine to construct two new-build 100,000-DWT Post-Panamax dry bulk carrier ships. The vessels, once constructed, will be deliver to an international energy trader on a long-term charter. The project will be funded through Hayfin’s Maritime Yield strategy and underlines the firm’s commitment to the Japanese shipping market, as both an asset-owner and long-term charter provider. The vessels will be managed by Hayfin’s in-house ship management platform, Greenheart Shipping.

The vessels will be constructed at Oshima Shipyard in the Nagasaki Prefecture of south-western Japan and completion is expected to take place within 2026. The vessels will be built to world-leading standards of quality and fuel efficiency, differentiating them from the majority of the current global Panamax fleet that is expected to be non-compliant with International Maritime Organisation sustainability regulations in three years’ time. With just two Japanese shipyards currently building Post-Panamax vessels, contributing to a historically low global orderbook, Hayfin was able to secure these two highly sought-after slots at one of the world’s leading dry bulk specialists through its longstanding relationships with key stakeholders in the Japanese market.

Andreas Povlsen, Head of Maritime at Hayfin, said: “This transaction is another sign of our firm commitment to the Japanese market and demonstrates the kind of attractive asset exposure we can offer to investors through our Maritime Yield strategy; combining fuel-efficient assets and long-term charters to investment-grade counterparties against a supportive long-term market backdrop with consistent tonne-mile growth and a fleet in urgent need of renewal.”

Hayfin recently announced a successful fundraise for its Maritime Yield strategy, equipping the firm with the capacity to acquire $1 billion in shipping assets through equity and debt financing, with a focus on top-specification assets that generate predictable and uncorrelated cash yields from blue-chip counterparties. Having been active in Japan since 2015, Hayfin also opened its Tokyo office last year, led by Tomohiro Hosogaya, the firm’s Head of Japan.